Insurance for motorcycle | Types of motorcycle insurance

Most states have some sort of "financial responsibility" requirement if you possess a motorcycle and intend to ride it on public roads. This implies that if you cause an accident, damage property, or injure someone, you may be held responsible.

|

| Motorcycle insurance |

Most bikers purchase motorbike insurance to comply with financial responsibility rules. Here's how to modify your motorbike insurance coverage so that you can ride with confidence.

What is motorcycle insurance?

Similar to auto insurance, motorcycle insurance offers coverage for your bike against theft, fire, fire damage, other people's property damage, injury to other people, and damage to your own bike, depending on the level of coverage you select. Your choice of policy will determine the kind and scope of coverage. |

| Types of motorcycle insurance |

Types of Motorcycle Insurance?

- Liability insurance

- Medical payments (MedPay)

- Comprehensive insurance

- Uninsured/underinsured motorist coverage

- Guest passenger liability

- OEM endorsement

- Collision insurance

- Total loss coverage

- Trip interruption coverage

- Roadside assistance

- Custom parts and Equipment coverage

Liability insurance

Pays for the harm and losses you cause to others, as well as your defense in the event that one of the other accident participants sues you.Medical payments (MedPay)

Regardless of who caused the collision, covers the cost of your medical care and that of your passenger.Comprehensive insurance

Pays for motorbike theft, vandalism, fire, and other damage.Uninsured/underinsured motorist coverage

Pays for motorbike theft, vandalism, fire, and other damage.Guest passenger liability

Covers your passenger's medical costs in the event that you cause an accident.OEM endorsement

Ensure that your motorcycle is repaired with parts from the original equipment manufacturer.Collision insurance

Pays for motorbike repairs after a collision with barriers like fences and guardrails.Total loss coverage

Aids in procuring a new or comparable motorcycle to replace your totaled motorcycle.Trip interruption coverage

Aids in covering the costs of food, hotel, and transportation if a mechanical or electrical failure leaves you stranded.Roadside assistance

Covers some costs associated with a mechanical or electrical breakdown, such as fuel delivery or towing.Custom parts and equipment coverage

Pays for the repair or replacement of aftermarket and custom items. |

| Motorcycle insurance |

How Does Motorcycle Insurance Work?

- Similar to auto insurance, motorcycle insurance provides coverage for injuries, property damage, and vehicle damage.

- If you have auto insurance, you'll note that the words for liability, comprehensive, and collision coverage are identical.

- Similar to how claims for auto insurance are handled, so is that for motorbike insurance.

- You must notify your insurance provider and submit a claim if your car is damaged or stolen.

- After reviewing the occurrence, the insurance provider chooses the reimbursement amount.

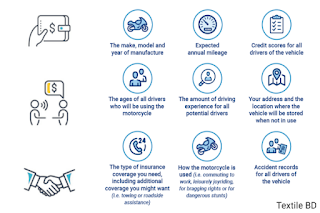

Factors that affect the cost of motorcycle insurance?

The cost of your motorbike insurance will be determined by a number of rating elements that insurance companies look at. Typical rating criteria include:- where you are

- Your record as a driver

- Your riding background

- Your motorcycle's model, year, body style, and engine size.

- Use frequency

- the distance you cycle each year

- Options for coverage

- The deductible that you select (for coverages like collision and comprehensive)

- Where you keep your bicycle when not in use.

- The safety aspects of motorcycles changes or personalizations made to the bike.

- Your total credit score (except in California, Hawaii, Massachusetts or Michigan)

Factors that affect your motorcycle insurance costs?

- Your age, driving history, and residence.

- in where you keep your bike.

- Your preferred bike, such as a sport bike, cruiser, or custom motorcycle.

- the distance you cycle each year.

- The motorcycle's age

- Motorcycle insurance coverage differs, so as usual, compare your options and find an insurer and insurance specialist you are at ease with.

Tips for the cost-conscious rider?

Similar to auto insurance, maintaining a spotless driving record will lower your premium payments. Some insurers also provide driver discounts and additional motorcycle insurance savings options.Read more...

The following is a selection of the offerings, which may differ by state and insurer:

- Training course discounts

- Multi-bike discounts

- Lay-up” policy savings

- Organization member discounts

- Mature rider discounts

Training course discounts

Graduates of programs like the Motorcycle Safety Foundation (MSF) rider course are eligible for discounts on training courses. Riders under the age of 25 may find this to be especially helpful because they are typically viewed as higher risk. Additionally, it's a smart move for riders who have already been in accidents.Multi-bike discounts

Riders who insure more than one motorcycle may benefit from reductions for several motorcycles. If one is offered, you may be eligible for a multi-policy discount if you purchase your policy through your home or auto insurer.“Lay-up” policy savings

Lay-up insurance, which is mostly offered in northern U.S. states, enables the driver to save money by excluding all coverage other than comprehensive during the winter months when the motorcycle is not in use.Organization member discounts

If you are a member of a motorcycle club or another organization, you may be eligible for discounts.Mature rider discounts

Discounts for experienced riders might help them save money. |

| Motorcycle insurance |

Top 8 ways to save money on your motorbike insurance?

- Shop around

- Ask for discounts

- Increase your deductible

- Keep a clean record

- Secure your bike

- Drop Collision coverage

- Don’t cancel your policy in the winter

- Make and model

Shop around:

To discover the best coverage at the lowest prices, shop around. Verify that the coverage and deductible amounts being compared are the same.Ask for discounts

Find out if you may save money by bundling your home and auto policies with your existing insurer. Other reductions might be accessible.Increase your deductible

A greater deductible can lower your premiums if you can afford it.Keep a clean record

In general, rates are going to be higher for younger riders or someone with a history of reckless driving.Secure your bike

Your insurance rates can decrease if you lock up your bike and put an anti-theft device on it.Drop Collision coverage

In the case of an older motorcycle with a low replacement cost, collision insurance might not be worthwhile.As a result, you are not insured for damage to the bike in a hit-and-run, single-vehicle, or at-fault accident.