What is health insurance | Types of health insurance

What is health insurance?

Health insurance is one such agreement. For which an insurer receives some or all of the cost of healthcare from the insurance company in return for a premium. A health insurance policy covers medical expenses due to an accident, illness or injury. |

| health insurance |

And a person can take such policy for a fixed period with monthly or annual premium. Moreover, during this period, if any insurer suffers any kind of accident or serious illness. However, the money spent on medical expenses is borne by the insurance company providing the insurance.

More specifically, health insurance usually covers the cost of medical treatment, surgery, prescription drugs, and sometimes the dental treatment offered by the insurer.

How does health insurance work?

Like all insurance policies, health insurance helps you deal with the financial impact of an accident or emergency. You will have to pay premium depending on your age, medical background, required insurance and the type of plan you have chosen. However, in some cases the insurance provider may ask you to undergo some medical examination before making a decision.Once the terms are finalized you will be issued a policy. The beginning waiting period is only a few weeks or one month. If you are able to get treatment in a hospital. However, you can tell the insurance company about the cost.

And the company will contact the hospital authorities directly for all payments. And when you get discharged from the hospital, you only have to pay the extra costs.

|

| Types of health insurance |

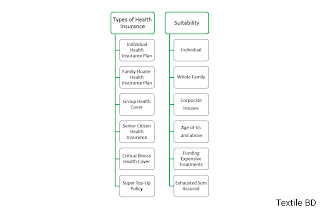

Types of health insurance?

- Personal health insurance

- Complicated Illness Insurance

- Family Floater Health Insurance

- Senior Citizen Health Insurance

- Top-up health insurance

- Group Health Insurance

What is personal health insurance?

A personal health insurance policy, as the name implies, covers the cost of a person's treatment. And this insurance policy can be used for you, your parents including your wife and children. Under this plan each family member will get a separate insurance.For example, if the sum insured of your plan is $2,000. Then each family member can use up to $2,000 for that policy term. That means if you purchase a separate insurance plan for three members. Then the insurance premium for three people is 6 thousand dollars.

What is Complicated Illness Insurance?

There are a number of lifestyle related diseases that are increasing day by day. Long-term health problems such as cancer, stroke, kidney failure and even cardiac disease can be very costly to deal with and manage.And this is exactly why critical illness insurance policies have been created. These can be purchased as riders. Or they can be purchased as an add-on to your regular health insurance plan or separately as their own plan.

What is Family Floater Health Insurance?

Under this type of insurance plan a single insurance is available for all persons under one policy. This entire money is distributed for the treatment of one person, respectively.In that case no further claim is made in case of any other medical emergency. However, senior citizens are not eligible under the Family Floater Plan. Because their medical costs are more complicated.

What is Senior Citizen Health Insurance?

Only people over the age of 60 get such a plan to cover all the medical expenses of the elderly. Insurance companies pay extra premiums to most senior citizens. Such as being admitted to a residential hospital and even being offered some psychological benefits.What is Top-up health insurance?

Many times the cost of the treatment you estimate when taking out health insurance can increase over time. Although your insurance remains unchanged. And in this case, instead of buying a separate insurance plan.You can buy a top-up for your existing premium. And this top-up plan helps increase overall insurance coverage. Which you can easily use in any emergency.

What is Group Health Insurance?

In addition to personal and family plans, group health insurance plans for a large number of people can be made by a group manager. For example, an employer may purchase group health insurance for all its employees. Or the building secretary can buy such insurance plans for all the occupants of the building.These plans are fairly affordable but often provide a premium only for primary health problems. Moreover, employers often buy these plans as an additional benefit for employees.

Health insurance benefits?

It is very important to have health insurance for various reasons. The important benefits of a health insurance policy are given:- Helps to avoid rising medical costs

- No claim bonus

- Cashless Medicine

- Complex illness cover

- Tax savings

Helps to avoid rising medical costs

People buy health insurance policies to protect their finances against rising medical costs. And an accident or medical emergency may cost you more than a few thousand rupees.With a medical insurance plan you can enjoy cover for everything from ambulance charges to day care. So that it becomes much easier to get the care you need for your recovery.

No claim bonus

Insurance companies offer Notice Claim Bonus (NCB) to their policyholders. Those insurance policies make no claims at the end of the year. No claim bonus applies for personal health insurance as well as family health insurance.Cashless Medicine

Insurance companies usually have contracts with hospitals. Which is known as network hospital. By which cashless treatment is provided to the insured in case of hospitalization.And these hospitals reimburse the medical expenses incurred by the insurers. This means you can get treatment at these hospitals without paying anything.

Complex illness cover

Many health insurance policies cover the cost of serious illness at an additional cost. This may be another important factor in view of the increasing prevalence of lifestyle diseases nowadays. If you are diagnosed with a serious illness, you will be paid a single fee.And these problems are often very expensive to deal with. So protecting against serious illness is another important benefit of having health insurance.